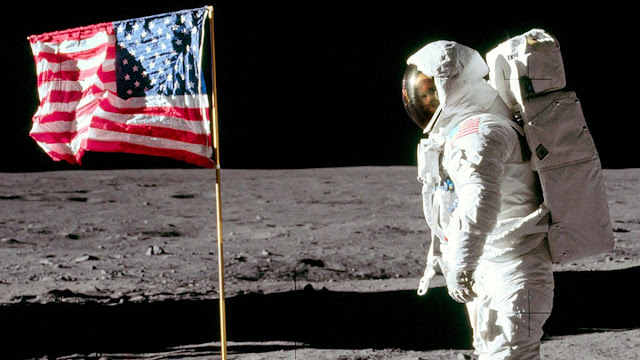

The legendary NFT auction took place to the moon over sixty years ago. It was a fashion of speaking. A portion items from NASA astronaut Buzz Aldrin's Apollo 11 legacy -- including the materials and equipment used in his revolutionary trip to and landing on the moon will be auctioned on the 26th of July on Tuesday According to the press release from Sotheby's the auction house that is the original house.

To mark their forthcoming Geek Week event, Sotheby's is hosting an auction entitled "Buzz Aldrin: American Icon". With NFT Expoverse's plans for giveaways relating to space along with numerous related to space NFT projects that will be released later this month, fans of space within the NFT community will find lots to be excited about.

NFTs could help preserve NASA's Apollo 11

The centerpiece of auction American Icon auction is the flight jacket Aldrin was wearing in his time on the Apollo 11 mission, along with the notorious broken circuit breaker during the mission, which resulted in the mission becoming even more stressful. These pieces -- together with other items from the legendary career of Aldrin that are included in the auctionare expected to fetch prices into the thousands.

But what does all this have to relate to NFTs? The circuit breaker that was damaged of Apollo 11, in addition to the felt-tip pen Aldrin used to write with on the spacecraft, are scheduled to be replaced by an NFT. These NFTs were issued through MIRA using a MIRAImage on Ethereum. Ethereum blockchain, thereby providing these items that are otherwise insignificant with a 100% guarantee of authenticity.

MIRA makes use of "sophisticated imaging technology and advanced algorithmic learning," According to the website. It can connect digital signatures to physical objects through scanning them at the microscopically-sized scale. MIRA also states that once an object is created in the form of an NFT the item will remain permanently on the blockchain regardless of the object's physical state. Because of this, those buying these typically difficult-to-authenticate objects can purchase or sell them at ease.

Comments

Post a Comment