The excitement surrounding NFTs persists despite troubled times. People feel nostalgic and proud about digital collectibles, just as they do about physical collectibles. Collectors often compare minting NFTs to opening a new pack of baseball cards. There's always the possibility of pulling out something rare, but you never know what will happen. Despite the fact that most PFP projects are limited to 10,000, the possibility of hitting big is enough to attract collectors.

Some use NFT rarity tools to "snipe" NFTs off the secondary market by identifying market opportunities where an NFT's rarity (read: market value) is misaligned with its list price. There are those who do both.

Let's explore NFT rarity tools to learn how rarity is calc

ulated, how to use them, and how to find the right tools for collectors.

What is NFT rarity?

An NFT's rarity is determined by comparing it to the rest of the collection. Market value and rarity are generally linked by supply and demand.

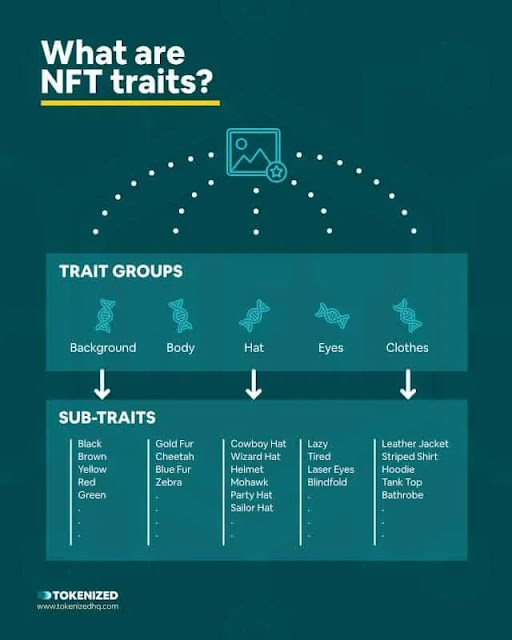

Rareness is primarily determined by the traits that make up a PFP token, or its various components and attributes. The most effective way to create objective rarity is to use trait groups, sub-traits, and 1/1 traits.

As an example, let's take the Bored Ape Yacht Club.

According to OpenSea, BAYC features seven distinct traits: background, clothes, earrings, eyes, fur, hat, and mouth. Depending on the frequency of their occurrence across the collection, each sub-trait carries a varying level of rarity. A count of total traits can also play a role, as in BAYC, where there are eight "sub-traits".

However, there are exceptions to every rule. Limited supply can drive value and demand with 1/1 or limited edition artwork. It is possible for a community to perceive the lack of traits or the matching of traits (think: red shirt and red pants) as having an added value. In BAYC, trait count is a community-specific attribute, with Apes receiving between four and seven traits. Due to their rarity and inherent value, there are only 254 Apes with four traits in existence.

Rarity tools are necessary to explore and uncover the nuance among NFT rarity.

What are rarity tools?

NFT rarity tools calculate and rank NFTs based on their rarity. Users can search specific tokens within their relative collection to determine how rare they are, and exactly what factors contribute to their rarity score. To better inform their purchase decisions, collectors can compare the rarity and value of individual NFTs within the same collection.

Although each rarity tool platform has its own proprietary scoring system, the rarity score itself will likely be different between platforms, even though the actual rarity ranking is the same.

Individual NFTs within a collection can be compared based on their rarity and value based on this information.

How is NFT rarity calculated?

In spite of the fact that there are three additional methods of calculating rarity (trait rarity ranking, average trait rarity, and statistical rarity), Rarity Score has proven to be the most accurate.

The formula was first introduced and implemented by the founder of rarity.tools, a popular rarity tool.

In order to solve biases in previous rarity calculation methods, this formula was created:

The rarity of a trait is ranked (ranking only the rarest trait).

Averaging the rarities of all traits

The statistical rarity of a trait (multiplied by all the trait rarities).

According to a rarity.tools blog post titled Ranking Rarity: Understanding Rarity Calculation Methods, if you compared three Apes using three different methods, you would get three completely different results. In contrast to trait rarity ranking, which places too much emphasis on rare traits, and average and statistical rarity, which doesn't place enough emphasis on them, Rarity Score is the perfect middle ground.

While the formula may differ, all rarity tool platforms now implement their own version of Rarity Score, resulting in the same accurate ranking results.

How to use Rarity Tools

Most rarity tools have sleek, straightforward user interfaces. Rarity Sniper is a popular rarity tool. Select a collection you'd like to explore. Enter your collection of choice into the search bar. Bored Ape Yacht Club will be used here.

An overview of the collection includes key statistics such as total supply, unique owners, floor price, and volume, as well as a ranking.

The collection can be sorted by ascending or descending ranking, price, NFT ID, and more on the left sidebar. Also available is a "Traits" switch, which displays all traits categories, subcategories, and occurrences.

To find the ranking of a particular NFT on OpenSea (or any other marketplace), find the token ID.

After entering the Token ID, click "Check Your NFT".

You can click on your token in the search results to reveal a full breakdown of its traits and scarcity within the collection, along with its ranking and rarity score.

Despite the fact that rarity tools have similar core functionalities, there are differences in design and features, so the user experience can differ. In order to find the right tool for your use case, we highly recommend exploring each tool in more depth.

Rarity Tools You Need to Know About

Rarity Sniper

Rarity Sniper is one of the most popular and robust Rarity Tools on the market, as shown in the example above. Nearly 1,800 NFT collections across 18 different blockchains are detailed on the platform, which has more than 492,000 Twitter followers and 321,000 Discord members. Users can stay up-to-date on the fast-paced industry with a full analytics platform, news outlet, and drop calendar provided by the "#1 Source for NFT Rarity.".

Rarity.tools

In contrast to Rarity Sniper, rarity.tools allows collectors to filter by all four methods of calculating rarity. Users can also explore specific attributes that platforms like Rarity Sniper do not offer. Although rarity.tools is a popular tool among enthusiasts, its UI is a bit clunky and difficult to use.

Although Swaggy Z acknowledges Rarity Tools' somewhat antiquated design, its simplicity has helped him better understand key purchasing opportunities across certain collections. Rarity Tools is perfect for users who are only interested in rarity information, as there are other trading analysis tools with more features.. "It does exactly what it should."

Trait Sniper

Known as "The Ultimate NFT Trading Platform", Trait Sniper is one of the most comprehensive NFT trading platforms on the market. With its bot, art is detected, rarity rankings are revealed and delivered instantly within 30 seconds. When setting mass bidding parameters, users can filter by trait, rank, and price. While browsing on OpenSea, Trait Sniper's Chrome extension provides rankings and floor prices.can be purchased on the secondary market on OpenSea.

Trait Sniper has become a go-to resource for Mikio Crosby, founder of the NFT Buy-Now Pay-Later platform Cyan. Trait Sniper's user experience wins out over other tools on the market.

In an interview with NFT Now, he said that NFTs are presented in spreadsheet format, which allows them to be scrolled through more easily. Sorting by category makes it easy to compare on the fly and filter by conditions as needed. You might find the user interface intimidating at first, but once you get over the small learning curve, it becomes a very powerful tool."

icy.tools

Trading decisions can be made more informed and educated with the all-in-one NFT analytics platform icy.tools. In 2021, it became the go-to resource for many serious traders, thanks to its premium plan with real-time charts and data, favorites, and firehose feeds.

Crosby says it ultimately boils down to personal preference and trader needs.

He suggested Trait Sniper to those wanting to find NFTs that haven't claimed airdrops quickly since the collection can be viewed in a table format. "Icy.tools has the best UI, but it gatekeeps some useful features. It's easier to use Trait Sniper without clicking around, but it does have the most comprehensive analytics. The top-down overview provided by NFTScan is the best, but it does not screen for wash trading. Although CryptoSlam is better at this, it is not always current.”

NFT rarity and the different tools available should be familiar to you by now. Remember, rarity isn't a one-size-fits-all game when it comes to NFT rarity. There are nuances to each collection and its tokens, and the industry is still young. Programs are continuously adding utility to previously “common” traits, which now command additional value.. One must learn the ins and outs of the industry to be an informed trader and collector. These tools only help crack a small piece of the puzzle: what you do with them is ultimately up to you.

Comments

Post a Comment